5 Tips for Beginner Traders in Crypto: Expert Advice for Successful Trading

Trading in the stock market or cryptocurrencies might captivate a lot of you guys, but making a stable earning or full-time career out of it is like carving a stone. It is not impossible, but there are certainly some difficulties to catch due to several complexities and technicalities in the field.

For a beginner, there are a lot of things and criteria to consider prior to making a move. One wrong move can drown you deep into the bog of loss. Whereas, if you are patient and smart enough to make the right decisions, trading can be heaven for you.

Starting the decision whether to go for an individual investing opportunity or going for a company, this write-up will guide you with easy and effective beginner tips to start with.

Understanding the Basics

As promised, here are some basic pointers that will help in laying the foundation of your trading journey. Therefore, without causing any delays, let us dive straight into them:

- Developing a Trading Strategy: A strategy is the best tool that can make anyone conquer or lose a situation. In your case, building a strategy to trade can give you a clear sight plan and insight into how you must proceed with your plan. You can seek advice from experienced players to get an idea of how to deal with things.

- Determine Your Financial Goals: You will not be able to achieve your dreams if you do not have a clear vision of them. The same things go for your finances. If you do not know what you want from the market or what you crave, the whole journey will be a mess.

- Identify Your Trading Style: Diving deeper into the basics, you must be aware of different trading styles. There are multiple variations in trading such as day trading, swing trading, and position trading. Since they are different from each other, the plan to deal with them also varies.

- Develop a Risk Management Strategy: Life does not go straight. There will be ups and downs in your entire journey. But that does not mean you have to sit back. Invest your time in creating an effective risk management strategy. Cover as many losses as you can to lessen the burden on your account.

- Backtest and Refine Your Strategy: Perform a brief analysis of past history of a currency to learn about its performance over the different points of events. This analysis will provide you with an idea of how the currency gets affected by a particular pattern and will allow you to shape your master plan accordingly.

Analyzing the Market

Analyzing the market is a technical stage of trading and requires a lot of brainstorming. However, once you master this, predicting future events in the market will be a piece of cake for you. You can start by:

- Use Technical Analysis: Numerous charts and indicators present the performance of a currency. Based on these indicators, you can get assistance in decision-making when to buy or sell a deal.

- Follow Fundamental Analysis: As the name suggests, fundamental analysis performs a study on health, management, and industry strength so that you can judge whether investing in a particular place would be sustainable or not.

- Stay Up-to-Date: Staying informed with the latest happenings and conditions of the sector can alarm you on when to invest or draw your money out of the currency.

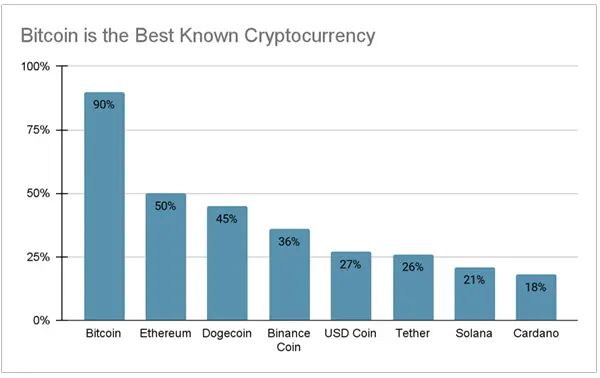

Speaking of cryptocurrencies, these are the most popularly known cryptocurrencies among the population.

Executing Trades

Since your hard-earned money is involved in trading, executing trades at the right time becomes paramount. Speaking of cryptocurrencies, a decentralized crypto exchange allows you to buy or sell the currency without a central authority. Follow these steps to learn how to perform execution:

- Choose the Cryptocurrency and Trading Pair: Creating a pair of cryptocurrencies of your choice and making a trade can be a great idea. You can use this combination to trade with each other.

- Place a Buy or Sell Order: As their name suggests, you can place your buy and sell order on a cryptocurrency on your terms.

- Set the Price: Setting a price lets you buy or sell your currency on a fixed level of amount. For example, if you set up the purchase order on a lower price level, your order will be executed when the price reaches that point.

- Confirm the Order: Review and confirm your order with the crypto exchange so that there is no mishap during the time you trade.

- Wait for the Order to be Executed: At this point, all you have to do is to wait for the right time when your order is executed based on the market condition and price.

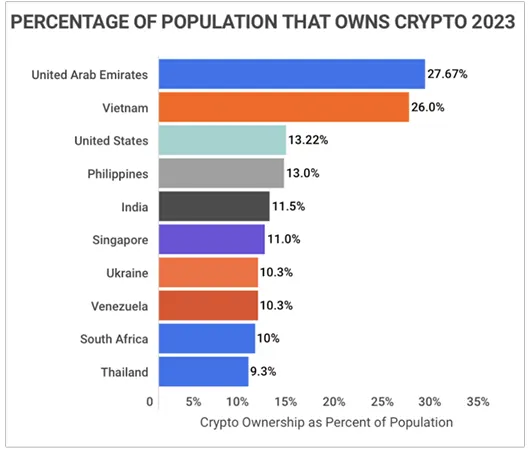

It is never too late to invest or trade in crypto

Final Words

This is how you can effectively trade your money into cryptocurrencies to multiply it exponentially. Please note that these markets are highly volatile and there is a huge risk of falling into losses. Therefore, make moves wisely.

Sorry, No post were found