Evolution of 2D Payment Gateway: Payment Aggregator Guide

With the introduction of new technologies and innovation in electronic commerce, the function of payment gateways has experienced an impressive makeover.

One of the most useful and interesting examples of these changes is the launch of the 2D payment gateway, which provides companies with an efficient method for managing transactions.

That’s why you should dive into this article that explores the evolution of the 2D payment gateway and how payment aggregators help to enhance business wealth and success through strategic partnerships.

The Integration of a 2D Payment Gateway in Today’s Financial World

The increasing digital use of financial dealings has caused companies to adopt 2D payment gateways, marking a significant withdrawal from traditional ways.

Unlike their 1D counterparts, 2D portals allow you to deal in transactions on websites and across multiple channels, including mobile devices and applications. This expanded use of this method promises to give you a more versatile and user-friendly experience.

You would know how the demand for security and seamless transactions has increased during the evolution of these portals.

But, with the progress made in encryption technologies, companies have become capable of securing the privacy of your sensitive information during online transactions.

Moreover, these methods are extremely flexible towards various platforms that stay in tune with the expanding pattern of the commerce sector and fulfill your changing demands in the contemporary market.

Companies think of it as a perfect example of progress in the payment portals to offer you a more tailored service and deliver a seamless experience.

The introduction of e-commerce platforms has come out as the most necessary component that will allow businesses to take their venture to a worldwide clientele, meeting their varied preferences and expectations.

This innovation offers a more interconnected and accessible digital marketplace that brings businesses and their consumers together, regardless of the platform (traditional online store, mobile application, or interactive website).

Strategic Partnerships: The Role of Payment Aggregators in Business Prosperity

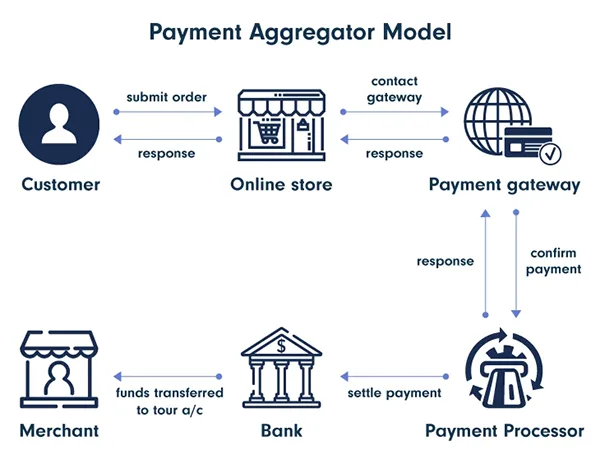

Digital payments are always going through a change, and payment aggregators play a pivotal role in offering you the experience of seamless transactions.

These companies act as intermediaries between businesses and financial institutions like banks, combining various payment options into a unified place.

The above graph shows the growth report of the payment gateway market in the US.

This blend not only eases the payment process but also improves the customer experience.

- Comprehensive Solution Provider: These methods play a vital role in meeting the various needs of businesses and offer a one-fits-all solution for payment processing.

- Facilitators for Integration: In the portals, these aggregators work as facilitators that help you to seamlessly introduce the technology into the already existing operations of the business.

- Simplified Implementation: This partnership makes sure that you can harness the full potential of the 2D payment doors without struggling with the difficulties that come with the implementations.

- Consolidated Transaction View: They offer businesses the key advantage of providing a combined view of transactions that helps you to put every transaction together and smoothen the reporting processes.

- Informed Decision-Making: It efficiently manages finances and allows you to make informed decisions based on real-time data, improving the ability to respond on time to market changes.

- Enhanced Security Measures: The aggregators help you to improve security in the transactions. They use strong measures to avoid fraud and check compliance protocols, keeping both the interests of the business and the security of the customers safe.

- Guardians of Financial Integrity: These methods act as the guardians of financial integrity and create a secure environment, giving you confidence in the digital transaction domain.

- Time and Resource Efficiency: If you entrust payment processing to methods, it will allow you to focus on core operations, saving valuable time and resources that can be directed toward strategic growth and innovation of the business.

Did You Know?

Jeff Knowles was the inventor of the challenges and struggles of creating the first Payment Gateway.

- Adaptability to the Digital Economy: The collaborative synergy between the business and these portals positions you to adapt effectively to the changing demands of the economy.

- Technological Delegation: Leave the complex aspects of financial transactions to these advanced methods to increase efficiency and make sure that you stay ahead of the technological advancements without becoming burdened by the pile of workload.

This partnership between 2D payment gateways and payment aggregators goes far beyond mere finance dealings. It helps you in the growth and scalability of businesses in the market.

Now, you can leave the complex processes in the hands of experts; the aggregators, so that you can focus on core operations. This will not only save time and resources but also position the business to adapt to the demands of the economy.

Conclusion

The growth of 2D payment gateways and the shared relationship with payment aggregators shows the dynamic nature of modern commerce.

If you are looking for a seamless virtual transformation, then using a 2D portal is the best choice. This shows not just a tech advancement, but rather a shift that changes the way you deal with transactions.

These methods overlook the payment and the related operations that contribute to the prosperity and success of businesses and create a harmonious ecosystem.

This metamorphosis not only satisfies the demands of contemporary technologically inclined consumers but also enables you to maneuver with assurance and effectiveness through the intricate landscape of digital transactions.

The future of international trade is expected to be significantly influenced by the development of 2D payment gateways and payment aggregators as financial technology continues to advance.

Also Read: How to Deposit and Withdraw Safely