Business Management: 4 Management Tips for Startups

Running a startup company can be challenging due to the many tasks you must manage. Meeting your client’s expectations, managing projects, handling employees and finances, and addressing issues are some of the many to-do things.

It’s not a surprise that most startups don’t even last one year. Don’t forget that several companies are in the same industry as you, and you need to compete with them and gain your customer base. Fortunately, many strategies and techniques can help ease your management tasks and assist your business grow.

This article will explore business management tips for startups.

Procure The Right Web-Based Tools

Managing your company requires a strategy and plan. That’s why you must ensure you have all the tools you need for adequate growth. One of the incredible tools to consider is the Prillionaires, which helps you calculate your organization and personal worth. This information can assist you make informed decisions on your budgeting. Note that there are also many communication, collaboration, productivity, and project management tools available online that can help you reach your potential. Note that some are open source while others are paid web-based tools. You must set a budget to purchase several of these mechanics since they will give you a competitive edge.

Open A Business Bank Account

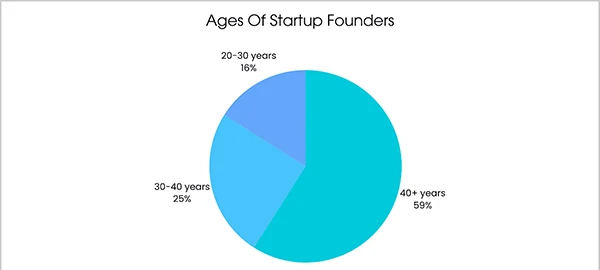

(This graph shows the ages of startup founders in percentage).

When setting up your startup, one of the vital things to consider is creating a business bank account. If it’s a cash management, checking, or savings account, opening a budget for your company is a great move. Some of the advantages include:

- It offers Legal Protection: One of the significant advantages of opening a bank account is that it provides limited personal protection regarding your business structure. If your organization gets sued, the bank account can help prove that your enterprise is a separate entity from you, which helps protect your assets.

- It Prepares File Your Tax: Having a business bank account assists separate your company and personal money, which makes it easy for you to file your taxes. Assuming this step can make managing your finances difficult, especially when untangling business and personal expenses from each other.

- It helps You Appear More Professional: When customers can pay money to your business account rather than your account, it makes your organization look professional.

Manage Your Cash Flow Effectively

For your company to grow, you need to manage the money that moves in and out of your firm. When you make more money than you spend, that is a positive cash flow. However, poor cash flow management has a significant impact on the growth and success of your brand. Some of the better ways to avoid negative cash flows include:

- Closely monitor your savings and debt

- Ensure you send invoices as soon as possible

- If you anticipate you need extra money, borrow before the requirement arises

- Assess your business and device methods to cut expenses

Gauge Your Profit by Conducting a Financial Forecast

It’s necessary always to assess your business and try financial forecasting to know what to expect from your company. Note that most startup companies must achieve profitability in the first year to be stable. You can use management tools to help estimate profitability based on your present and past financial considerations. When you anticipate negative or low profitability, you can change your marketing tactics and other aspects that affect profitability.

Do You Know?

About 90% of startups fail, with 10% failing within the first year. The failure rate is highest for startups in years two through five, with 70% falling into this category.

Time To Run Your Startup

It’s vital while starting your business to research your funding needs carefully. This will include assessing your current financial position and the deficit you have. Don’t forget to use the right tool when managing your company to make work more efficient and improve productivity.