Credit Card Debt Relief Programs

KEY TAKEAWAYS

- Credit card debt relief programs are designed to provide assistance to individuals who are overwhelmed by loans and are unable to make the required minimum payments.

- Companies like CuraDebt, have experienced negotiators who communicate with creditors on behalf of the individual.

- Credit card is one of many unsecured loans.

Credit card debt can quickly become a significant burden for many individuals, leading to stress and financial strain. The good news is that there are relief programs available to help those struggling to manage their bills. In this article, we will explore what debt relief programs are, how they work, and the benefits they offer to individuals seeking to regain control of their finances.

Understanding Credit Card Debt Relief Programs:

Relief programs are designed to provide assistance to individuals who are overwhelmed by the outstanding amount and are unable to make the required minimum payments. These programs aim to alleviate the financial burden by negotiating with creditors to reduce the total amount, lower interest rates, or create more manageable payment plans.

The Process of Credit Card Debt Relief:

Financial Assessment:

The first step in a program is a comprehensive financial assessment. This assessment involves evaluating the individual’s income, expenses, and outstanding amount to determine the most suitable debt ease option.

Customized Debt Relief Programs:

Based on the financial assessment, a customized plan is created to address the individual’s unique needs and financial situation. The plan may include settlement.

Negotiations with Creditors:

Relief companies, like CuraDebt, have experienced negotiators who communicate with creditors on behalf of the individual. They aim to reach a settlement that reduces the total amount and creates a feasible repayment plan.

Payment Process:

Once a settlement is reached, the individual can make payments according to the agreed-upon terms. In some cases, a lump sum payment may be required, whereas other programs may involve monthly payments.

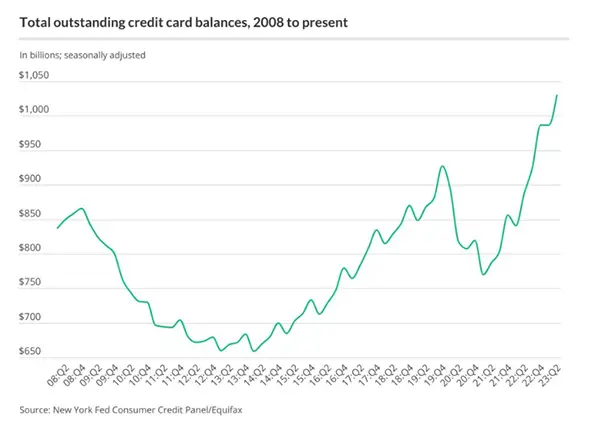

TIP:This graph shows the total outstanding credit card balances from 2008 to the present according to New York Fed Consumer Credit Panel

Benefits of Credit Card Debt Relief Programs:

Reduced Debt Burden:

One of the most significant benefits of programs is the opportunity to reduce the overall burden. By negotiating with creditors, individuals may end up paying less than the total amount owed, providing much-needed financial aid.

Avoiding Bankruptcy:

Credit card aid programs offer a viable alternative to bankruptcy, allowing individuals to resolve their debts without taking such drastic measures.

Expert Guidance:

Debt relief companies like CuraDebt have a team of experts with knowledge and experience in dealing with creditors and negotiations. Their guidance can significantly improve the chances of reaching favorable debt settlement programs.

Unsecured Debt in Credit Card Debt Relief Programs:

Unsecured loan refers to debts that are not backed by collateral. In the context of a loan, it means that the company does not have any claim on the borrower’s assets if they fail to repay the amount. Unlike secured debts (e.g., mortgages or car loans), where the lender can repossess the asset used as collateral, the bill is unsecured and poses a higher risk for creditors.

Types of Unsecured Debt:

Credit card debt is one of the most common types of unsecured debt. Moreover, personal loans, medical bills, utility bills, and certain types of unsecured lines of credit also fall under this category.

CuraDebt: Your Trusted Partner in Credit Card Debt Relief:

CuraDebt is a reputable relief company with years of experience in helping individuals find effective solutions for their bills. Their team of professionals understands the complexities of negotiation and works diligently to reach favorable settlements with creditors. CuraDebt offers a range of debt relief programs, including settlement, and negotiation services. With CuraDebt’s expertise and commitment to customer satisfaction, individuals can find a clear path to financial freedom. They tailor their programs to meet the specific needs of each client, ensuring that the chosen solution aligns with their financial goals.

Conclusion:

If credit card debt has become a burden in your life, don’t let it overwhelm you. These programs offer a ray of hope for those seeking to regain control of their financial well-being. Be it settlement or negotiation services, the right program can pave the way to financial freedom. Consider seeking professional assistance from reputable companies like CuraDebt, and take proactive steps towards resolving your bills. With expert guidance and a well-structured relief plan, you can embark on a journey toward a debt-free and financially secure future.