The Asian Trading Session

The realm of Forex trading has rapidly expanded across the Asian region, resulting in the rise of numerous financial hubs that offer a multitude of trading opportunities. Given the volatility and liquidity of the global foreign exchange market, the significance of selecting a suitable Forex broker in Asia is paramount to the maintenance of profitability.

A seasoned trader might possess unparalleled expertise, but if they choose to operate through a broker that falls short in regulatory compliance, inadequate trading tools, or exorbitant spreads, their hard-earned profits are likely to be compromised. Hence, it is imperative to delve into the intricacies of Forex trading in Asia and evaluate the various factors contributing to a broker’s competency.

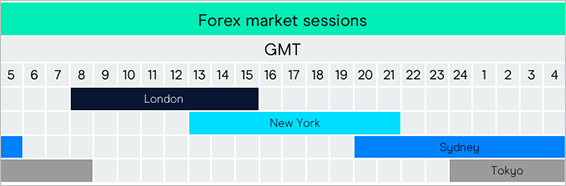

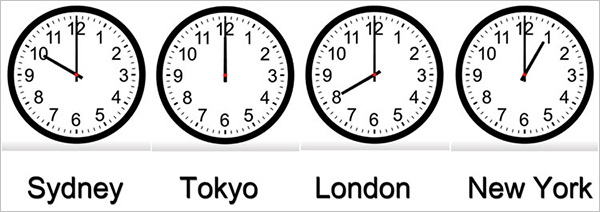

The market has traditionally been divided into four sessions: the Asian session, the European session, the Australian session, and the North American session. These sessions are also known as the Tokyo session, the London session, the Sydney session, and the New York session respectively. We use these names interchangeably because these three cities are the main financial centers for each region. The markets are at their most active stage when these three powerhouses are on to real business and trading.

In this article, we delve into the Asian trading session and provide a comprehensive analysis of the various aspects traders must consider when selecting an appropriate Asian Forex broker. The article serves as a guide for seasoned traders seeking to expand their Forex trading endeavors in Asia and provides a nuanced understanding of the region’s regulatory environment and trading hubs.

A Bit Into The Asian Trading Session

The Asian session is the opening time of forex trading in the Asian markets. It is the first session of a trading day held after the weekend. It is often used interchangeably with the Tokyo session. During this time period, the trading market in most of the Asian countries is considered to be at its peak.

The Asian session lasts from 12 AM to 8 AM GMT. Asian session is typically used in the same sentence as Tokyo session. However, it is important to know that many other countries, such as China, Australia, and New Zealand, as well as Russia, are also present during the Asian session. This means that the Asian session extends beyond the Tokyo session. The Asian session changes on the day of daylight savings time.

Regulatory Landscape in Southeast Asia

The Southeast Asian region presents a complex and arduous regulatory landscape for Forex brokers. In particular, countries such as Indonesia have implemented stringent regulations mandating that only locally licensed brokers are permitted to establish a physical presence within the country.

Conversely, Malaysia has established a licensure system in Labuan, catering to international CFD trading and Forex brokers, but they still need to be allowed to operate within the country properly. This has led to a proliferation of brokers operating in an unregulated capacity, thereby exposing traders to a significant degree of risk.

Despite the associated dangers, it is imperative to acknowledge that some unregulated brokers have established a formidable reputation. They maintain offshore regulation from esteemed regulatory bodies such as Britain’s Financial Conduct Authority (FCA) and Australia’s Australian Securities and Investments Commission (ASIC).

This not only offers traders a modicum of confidence and protection but also provides them with the opportunity to take advantage of higher leverage and bonuses, which are often unavailable through regulated brokers. However, exercising caution and undertaking a rigorous assessment of the risks involved in trading with an unregulated broker is essential.

The Concentration of Forex Trading Activity in Asia: A Regional Overview

As one of the most dynamic financial regions in the world, Asia boasts a plethora of centers for Forex trading activity, each of which plays a critical role in the larger global currency market. Among these, Singapore stands out as the veritable epicenter of Forex trading in Asia.

With a vast array of futures and options contracts available for trading and a thriving brokerage community sanctioned by the Monetary Authority of Singapore. This flourishing ecosystem has attracted the regional offices of the world’s largest banks, all of which have set up shop in Singapore to take advantage of its unparalleled Forex trading opportunities.

Another prominent hub of Forex trading in Asia is Japan, where the Asian trading session – accounting for a significant 20% of total Forex trading volume – is hosted in the bustling financial district of Tokyo. It is also noteworthy that a substantial portion of all Forex transactions, approximately 16.8%, are denominated in Japanese yen, making it a currency of choice among Forex traders.

In addition to these two main Forex trading centers, other countries in the region, such as Hong Kong, Indonesia, Malaysia, and Thailand, also play a vital role in the Asian Forex market. Each offers its unique set of advantages and challenges for traders.

The Bottom-Line

In conclusion, the Asian Forex market is a dynamic and challenging arena for traders, requiring a thoughtful approach to navigate the intricacies of the region’s regulatory landscape and a deep understanding of the different Forex trading hubs.

The importance of choosing the right broker must be considered, as the varying regulatory requirements in regions/countries such as Indonesia, Malaysia, and the Philippines, make it imperative to work with a trusted and regulated entity.

The hub cities of Singapore, Japan, and Hong Kong each offer unique advantages and opportunities. The former is the largest Forex trading hub in Asia, Japan is a crucial hub for the Asian trading session, and Hong Kong is an important financial center.

With a well-crafted forex strategy, due diligence, and a thorough comprehension of the complexities of the Asian Forex market, traders have the potential to unlock a wealth of opportunities and reap substantial profits.

However, it is imperative to remember that success in this arena requires a long-term perspective and a steadfast adherence to risk management principles.

In essence, the Asian Forex market presents a rich tapestry of opportunities, but it is up to each trader to carefully weave a path to success.