9 AI Innovations That Are Helping Us to Make Smarter Financial Decisions

The financial service industry is undergoing a major transformation driven by the rapid advancement and adoption of artificial intelligence (AI) technologies.

From established banks to FinTech startups, more and more financial institutions are leveraging AI to innovate their offerings, improve efficiencies, reduce risks, and provide more personalized services to customers.

In this article, we will explore some of the most impactful AI innovations that are redefining the financial sector.

Visit Now and Learn the power of financial investment education.

Predictive Analytics for Risk Modeling and Management

Banks and other financial organizations can now leverage AI-powered predictive analysis to get more accurate insights for detecting risks and anomalies. By analyzing large amounts of structured and unstructured data, machine learning algorithms can identify patterns and detect risks faster than traditional methods.

For instance, predictive analytics enables more efficient credit risk modeling by extracting insights from a borrower’s data history as well as wider credit patterns. This allows banks to optimize lending decisions.

DID YOU KNOW?

AI has the potential to increase financial services revenues by 34% and economic growth by 26%.

Personalized Banking through Chatbots and Robo-Advisors

Banks are increasingly adopting AI-powered chatbots and robo-advisors to offer personalized banking services 24/7. Chatbots handle common customer queries, while robo-advisors provide tailored financial recommendations on investments, expense management, and more.

For example, Bank of America’s chatbot Erica has over 10 million users. And Wealthfront’s robo-advisor has over $25 billion in assets under management. AI is enabling scalable and customized advisory.

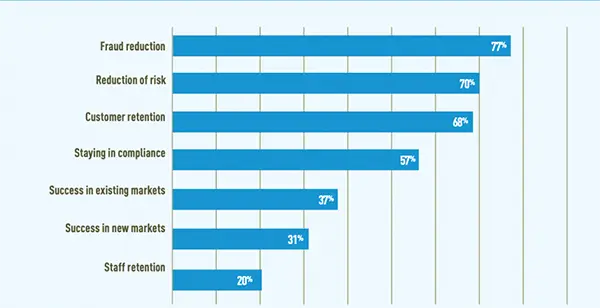

Automated Fraud Detection

AI and automations in proprietary trading is transforming fraud prevention in the finance industry by enabling real-time monitoring of millions of transactions to detect any anomalous activity. Sophisticated machine-learning techniques can identify patterns, correlations, and data points that may indicate fraud.

This has helped banks dramatically reduce false positives and improve fraud detection accuracy. According to McKinsey, AI can deliver a 30–50% reduction in false positives for anti-money laundering surveillance.

Algorithmic and High-Frequency Trading

Algorithmic trading, which uses AI and machine learning to make trading decisions, now accounts for over 70% of orders in US stocks. AI enables faster and more informed trades by analyzing news, data patterns, and signals.

High-frequency trading relies on advanced AI to transact a large number of orders in fractions of seconds. AI is transforming trading to be faster, more efficient, and more profitable.

Personalized Marketing and Recommendations

By analyzing customer data and activities, AI can allow financial institutions to provide personalized product recommendations. Chatbots can also engage customers in tailored conversations about offers.

Companies like CapitalOne use AI to customize card offers to customers based on their spending habits. Personalization in marketing and advisory is a key to AI innovation.

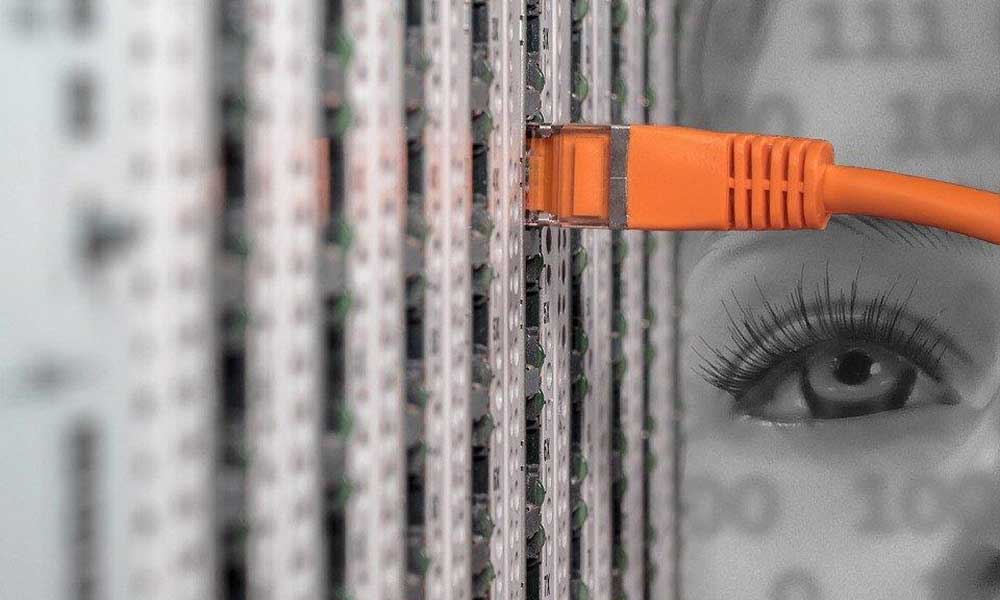

Improved Cybersecurity Through AI

With rising cyber threats, AI is playing a key role in beefing up cybersecurity in the financial sector. AI algorithms can detect anomalies, identify malicious activities, and respond to threats in real-time.

For example, Darktrace’s AI spots emerging cyber attacks and takes targeted actions without human assistance. AI is transforming defense against hackers.

Sentiment Analysis from News and Social Media

AI can analyze sentiments, opinions, and emotions expressed about companies, stocks, mutual funds, etc. on news and social media. This captures crucial data to make informed investment decisions in trading firms.

For example, JP Morgan’s deep learning model Volt can parse financial reports and extract key sentiments faster than humans. Sentiment analysis is a powerful AI tool.

RegTech for Regulatory Compliance

Financial Institutions need to comply with a complex array of regulations for reporting, auditing, risk management, and more. RegTec refers to AI solutions that help institutions be compliant efficiently.

For instance, AMLBot is an AI solution for simplifying anti-money laundering compliance. Big data analytics also provides insights into regulator expectations.

Quantitative Analysis for Investment Insights

Quantitative analysis also known as Quant Models powered by AI is transforming investment research and insights. By crunching vast datasets, machine learning quant models can reveal predictive patterns and data-driven market co-relations.

BlackRocks Alladdin AI performs quant model analysis of portfolios to optimize risk-adjusted returns. The quant analysis gives investment firms an AI advantage.

The Future of AI in Finance

As AI adoption grows, emerging innovations like DeFi, predictive behavioral modeling, speech recognition for documentation, etc., will drive the next wave of disruptions in finance. Startups are investing heavily in AI to shape the future.

Financial institutions will need to embrace a comprehensive AI strategy covering aspects like data management, modeling governance, ethics, and skills. With responsible AI adoption, the banking and finance sector is poised for greater accessibility, efficiency, and value creation.

Conclusion

From algo trading to personalized advisory, AI is fundamentally changing financial services. As the examples in this article highlight, AI is being deployed across the industry for use cases like risk management, fraud prevention, process automation, regulatory compliance, and more.

Powered by big data and machine learning, these Artificial intelligence technologies are driving immense value by optimizing processes, reducing costs, uncovering insights, improving compliance, and enhancing customer experiences.

Financial institutions that strategically invest in ethical and responsible AI will be best positioned to ride the AI revolution wave that is rephrasing the sector.

- Predictive Analytics for Risk Modeling and Management

- Personalized Banking through Chatbots and Robo-Advisors

- Automated Fraud Detection

- Algorithmic and High-Frequency Trading

- Personalized Marketing and Recommendations

- Improved Cybersecurity Through AI

- Sentiment Analysis from News and Social Media

- RegTech for Regulatory Compliance

- Quantitative Analysis for Investment Insights

- The Future of AI in Finance

- Conclusion