How to Choose a Forex Broker?

Foreign exchange has grown in the modern world. More and more people have made their way by investing in foreign currencies and having the right middleman is as important as knowing about the economic condition of the market. This is where a forex broker comes in.

For the general audience, a Forex Broker is someone who acts as a middle man between a trader and the market. Tons of people place bets on world currencies, which simply means buying and selling currency pairs based on economic developments that happen all over the globe.

An astonishing amount of $4 trillion per day is transacted in currency trading, an amount that is larger than the world’s stock or bond markets. If you are looking to know how you can choose the right broker for yourself, read this blog till the end to know about the same.

Before you move forward, you need to make up your mind as to what your goals are when it comes to investing and what kind of an investor you are. Every broker featuring forex investments comes with pros and cons. Also, keep in mind that security features vary from broker to broker. There are plenty of brokers that offer integrated security features such as two-step authentication to keep accounts safe from hackers and spammers.

Different associations regulate brokers in different nations. For instance, the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC) regulate the brokers in the USA while other bodies regulate brokers in France, Australia, Germany, Austria, Canada, and the United Kingdom. But keep in mind that not all brokers are regulated and one should steer clear of unregulated brokers.

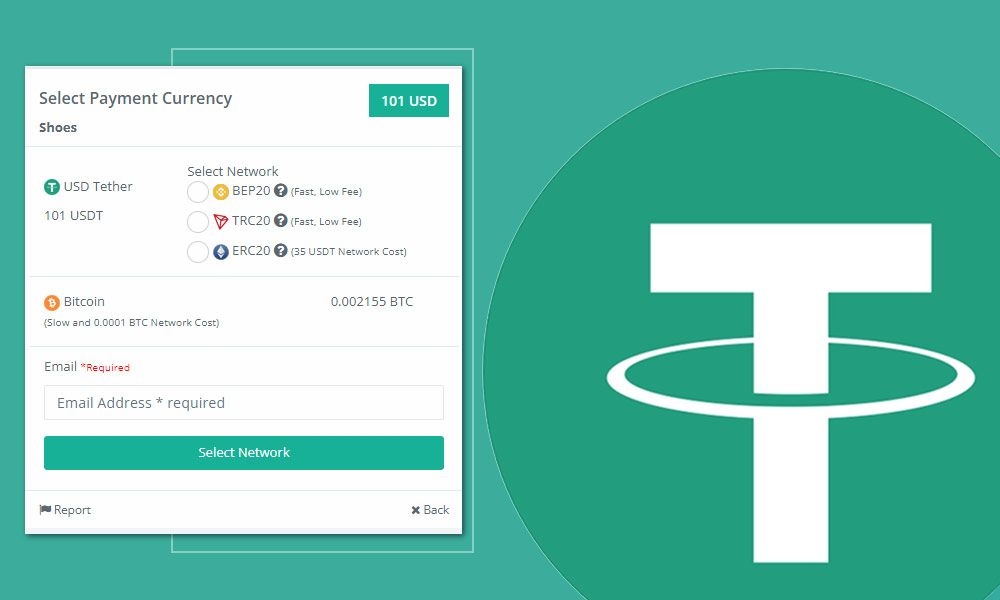

Different brokers also differ in platforms and also require minimum account balance and transaction fees. This is why you need to create a budget for your investment journey before you hop on a trading platform. Get a rough idea as to how much would you like to invest and how much are you willing to pay for your goals.

Tons of factors are involved in choosing the right platform which is why you should know as much as you can before you make a decision.

Let us now get to know about the currency pairs of Forex

In simple terms, a currency pair compares the currency of two currencies with the help of a numerator/denominator relationship. The process goes with a quote currency on the bottom and a base currency on the top. Think of it like this. EUR/USD currency pair is considered the most popular forex trading instrument where EUR is the base currency and USD is the quote currency.

Every ratio is quoted in two to five decimals and it even comes with a flipped over version, simply creating a new currency that moves in the opposite direction. The dynamics of the trading world have changed significantly over the years. Margin accounts are also of great importance. Let us get to know more about it.

Whenever a new forex account is opened, it is known as margin accounts. Such accounts offer more trade size than the current account balance.

One should keep in mind that the safety of your funds and private information is more important than any other thing to consider when you open an account since it is pretty normal for forex accounts to get hacked or to go bankrupt. As opposed to stockbrokers, where the funds of the clients are protected by SIPC, brokers in the US do not offer any sort of protection if things go south.

To add insult to injury, forex brokers can recover more than your account balance via legal action in *case it doesn’t offer negative balance protection.

A question that is pretty popular among investors is whether the forex broker offers trading education and tools or not. Yes indeed. It is known that high-end brokers offer a wide range of resources for clients to improve trading skills and to make smarter decisions.

The concept of social trading has also picked up pace in a recent couple of years and is also available at every reputable broker.Everything that you get to know about forex brokers only leads to one thing. That is, that one should be very careful since a bad decision can be pretty costly. Reputed brokerage firms can better help you understand the tools and the basic dynamics of the trading world.