Revolutionizing Insurance: The Path to Enhanced Customer Experience and Operational Excellence

In the current scenario, the most resilient organization revolve their processes around how their customer interacts with them and what experiences they have after using their products and services.

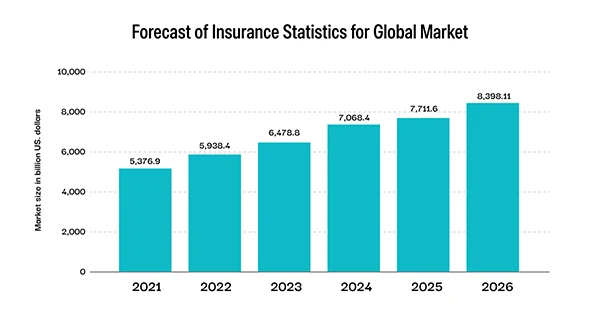

The insurance industry is not behind in that, as its success is completely based on the core principle that is efficient customer interaction. The market size of the industry is projected to grow in the coming years, expected to reach $10288.43 billion in 2028 at a CAGR of 7.2%.

Insurance companies need to navigate the complexities of processes with swift and efficient solutions. To align the seamless operations of the organization, it is necessary to employ compliance software to achieve the optimal level of customer experience.

In this article, we will help you in finding insurance compliance software, and stating the significance of customer interaction in the insurance sector, that leads to impacting the overall success.

The Imperative of Efficiency

Efficiency is indeed the linchpin of contemporary insurance operations. Amidst the relentless competition and shifting consumer demands, insurers face the imperative of perpetual improvement in customer experience.

At the core of this pursuit lies the optimization of customer interaction processes. Streamlining these processes expedites transactions and cultivates trust and satisfaction among clients.

Did you know?

Insurance is 4000 years old.

Insurers can foster a more seamless and intuitive experience for policyholders by minimizing complexities and bureaucratic hurdles. Swift response times further reinforce this commitment to customer-centricity, demonstrating a proactive approach to addressing inquiries and concerns.

Moreover, personalized engagement adds a layer of sophistication, catering to the individual preferences and needs of customers.

Embracing technological advancements, such as automation and data analytics, further augments efficiency, enabling insurers to anticipate and meet the expectations of consumers more effectively.

In essence, the relentless pursuit of efficiency in interaction processes is not merely a strategic choice but a fundamental prerequisite for success in the fiercely competitive landscape of the insurance industry.

Streamlining Compliance Processes

The right insurance compliance software is paramount for companies looking to streamline their compliance processes. These software solutions give a range of features designed to simplify compliance tasks, from managing policies and regulations to tracking deadlines and automating reporting.

By centralizing compliance-related data and workflows, insurance compliance software enables organizations to minimize the risk of errors, ensure consistency in adherence to regulatory requirements, and improve overall efficiency.

With customizable dashboards and reporting tools, these solutions provide real-time insights into compliance status, enabling proactive risk management and decision-making.

Enhancing Risk Management

Insurance compliance software goes beyond mere adherence management; it also plays a key part in enhancing risk management capabilities. By integrating risk assessment functionalities, these software solutions help insurance companies identify, assess, and mitigate compliance risks more effectively.

Organizations can proactively identify potential compliance issues through features such as risk scoring, and scenario analysis, and keep monitoring to take appropriate corrective actions.

This proactive approach helps mitigate regulatory risks, enhances overall operational resilience, and strengthens the organization’s reputation in the market.

Ultimately, compliance software empowers insurance companies to navigate the complex regulatory landscape confidently when optimizing risk management practices.

Simplifying Complexity

Insurance transactions often involve intricate procedures and extensive documentation. However, inundating customers with complex forms and bureaucratic hurdles only alienates them.

To thrive in the current competitive landscape, insurers must simplify these processes, ensuring customers can navigate them effortlessly.

The below statistics represent the forecast for the future growth of the insurance market globally.

One approach is to leverage digital technologies to simplify the documentation process. Electronic forms and online portals enable clients to complete necessary paperwork conveniently from any location, reducing the hassle of physical paperwork and postal delays.

Moreover, investing in user-friendly interfaces and intuitive design enhances the customer experience. Clear instructions, visual aids, and progress indicators guide people through each step, minimizing confusion and frustration.

Also, implementing automated workflows and decision-making algorithms accelerates processing times and decreases the likelihood of errors. By automating routine tasks, insurers free up resources to focus on more complex customer inquiries and service enhancements.

Ultimately, simplifying insurance processes improves customer satisfaction, boosts operational efficiency, and reduces costs. Insurers who prioritize simplicity and ease of use gain a competitive edge in attracting and retaining customers in the current dynamic market landscape.

Swift Response Times

In the modern, rapidly growing digital period, time holds the greatest significance among every possible factor. Customers expect prompt responses and resolutions to their queries and concerns.

Delayed communication or prolonged wait times can lead to dissatisfaction and erosion of trust, ultimately impacting customer retention and profitability. Insurers demonstrate their commitment to meeting the needs and expectations of people by prioritizing swift response times.

Here’s a Fun Fact

America Ferrera had her smile insured for $10,000,000.

Moreover, in the present hyper-connected world, news of poor customer service travels swiftly through social media and online reviews, further amplifying the repercussions of inadequate response times.

Conversely, efficient handling of inquiries and claims can serve as a powerful differentiator, fostering positive word-of-mouth referrals and bolstering the company’s reputation.

Also, swift response times are not only beneficial for resolving immediate issues but for preventing escalation as well. Proactive communication can help address potential concerns before they escalate into larger problems, mitigating risk and preserving customer relationships.

Ultimately, in a competitive landscape where customer experience is a key differentiator. So, prioritizing swift response times is not just a matter of operational efficiency, but a strategic imperative for enhancing consumer satisfaction and loyalty.

Personalized Engagement

Personalization has become a hallmark of exceptional customer service. By leveraging data analytics and insights, insurers can tailor interactions to meet each individual’s unique needs and preferences more effectively. This tailored approach goes beyond mere customization; it demonstrates a deep understanding of the customer’s circumstances and aspirations.

By providing personalized policy recommendations based on previous purchasing patterns or offering proactive assistance in navigating complex insurance processes, personalized engagement fosters more profound connections.

Moreover, personalization extends beyond the initial interaction. Insurers can use data analytics to anticipate future needs and provide timely, relevant support.

For instance, sending proactive reminders for policy renewals or offering targeted discounts based on past behavior demonstrates a commitment to meeting customers’ evolving needs.

By prioritizing personalization, insurers can differentiate themselves in a crowded marketplace and build long-lasting relationships with customers. Ultimately, it’s not just about selling policies; it’s about delivering value and peace of mind tailored to each individual’s unique circumstances.

Embracing Technology

Technology lies at the heart of modernizing insurance operations. It offers myriad opportunities to streamline customer interaction, from digital platforms to automated processes.

Chatbots, for instance, can provide instant assistance and guidance to customers, minimizing the need for human intervention and expediting resolution times.

Similarly, sophisticated analytics tools allow insurance companies to understand their customer’s behaviors and preferences in greater depth, facilitating interactions that are both more personalized and accurately targeted.

Mobile applications offer policyholders easy access to their policy details, claims, and other necessary information, significantly boosting satisfaction and engagement levels. In addition, the adoption of artificial intelligence and machine learning technologies streamlines the underwriting process, resulting in quicker policy delivery and decreased operational costs.

By adopting these technological advancements, insurance firms not only boost their operational effectiveness but also significantly improve the customer journey, ensuring their position for continuous growth and success in a constantly changing digital environment.

Seamless Integration

Integration is key to creating a seamless customer experience, as insurers can ensure consistency and continuity across touchpoints by integrating various systems and channels.

In case of transition from online to offline channels or accessing information across platforms, seamless integration eliminates friction and enhances efficiency.

Empowering Customers

Empowering customers with self-service options can immensely improve their experience. Providing intuitive online portals and mobile apps enables customers to manage their policies, file claims, and access information independently.

Empowering customers enhances convenience and reduces the burden on customer service teams.

Data-Driven Insights

Data is a valuable asset in understanding consumer behavior and preferences by harnessing data-driven insights, insurers can anticipate customer needs, identify trends, and tailor their offerings.

Predicting potential risks or identifying cross-selling opportunities, data-driven insights enable insurers to deliver more targeted and relevant interactions.

Continuous Improvement

Innovation and continuous improvement are vital to staying ahead in the insurance industry, embracing new technologies, refining processes, and soliciting feedback, insurers can continuously enhance the customer experience.

A culture of innovation fosters agility and adaptability, enabling insurers to respond effectively to evolving customer expectations and market dynamics.

Conclusion

In conclusion, discovering insurance compliance software is necessary and strategic for insurance companies. It simplifies complexity, prioritizes efficiency, embraces technology, and empowers the organization to meet regulatory requirements effectively.