Crypto Trading Bots: A New Era in the Cryptosphere

The world of crypto is a wondrous and captivating place. It has been all the hype in recent years. Since the inception of Bitcoin, the crypto market has seen an unprecedented rise in popularity. For getting more information and learning crypto trading, you can see the crypto price charts at any monitoring site.

This is especially the case in the crypto trading industry.

An advance cryptocurrency trading happens 24/7 which makes this mystical beast very hard to pin down. With the constant towering highs and the deep lows in its price, it becomes nearly impossible for any tracer to find an opportunity to safely invest in this beast.

Therefore, many avid crypto traders turn to trading bots to compensate for their limitations by using the algorithmic trading programs of the bots to execute their trading strategies for them.

In this article, we will discuss what crypto trading bots are, what their benefits and limitations are, and share some of the most popular bots in the market with you.

What are Crypto Trading Bots?

“A crypto trading bot is actually an automated program that runs on the blockchain and scans the different decentralized exchanges. It can wait for cryptos to essentially fall out of sync to spot those investment opportunities and execute them on behalf of traders.”

These bots can work around the clock to compensate for the trader’s human limitations and can help achieve optimal trades in the market.

The types of trades these bots can execute differ between bots with some pro traders developing their own programs to capitalize on the inefficiencies of the market.

DID YOU KNOW?

The majority of crypto trading bot users are between the ages of 25-34.

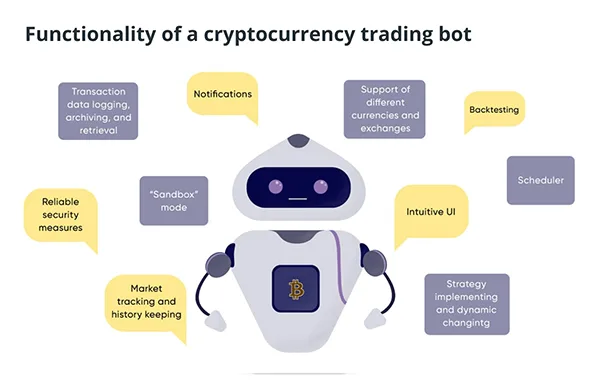

How Does a Crypto Trading Bot Work?

Trading bots are automated software programs that are developed by third parties. You can usually buy to subscribe to a trading bot software or even download one for free from Crypto Hero. Besides, you also need to have some basic understanding of coding and technical analysis in most cases.

You can use a bot by simply connecting it to exchanges using an API (Application Programming Interface). An API is an interface that allows bots to connect with the exchanges and execute and manage trades on the trader’s behalf.

They make trades based on simple or complex predefined markers and indicators. Some common markers include price, time range, and order volume, while common market indicators include Moving Averages, RSI, and more.

You would still have to carefully vet the markers and indicators because they can determine how the bots monitor the market situation and execute your trades.

Since the bots have direct access to your crypto assets and can make trades on your behalf, you also need to restrict your API on how your bots should be allowed to act. Moreover, you would also need to test your trading strategy before actually letting the bot run amok with most of your portfolio.

Advantages of Using Crypto Trading Bots

- Effective Trading Process: Crypto trading bots can offer more efficient trading by automating the trading process. It can help traders by keeping track of all their digital assets and observing different markets simultaneously. Also, it removes the need for any manual labor on the trader’s part.

- 24/7 Online: They can work around the clock, monitoring and executing trades by successfully finding good opportunities in a volatile market.

- Higher Accuracy: When it has the right kind of parameters set up, a crypto trading bot has better trading accuracy and market timing thereby increasing a trader’s profits.

- No Human Emotion: It eliminates the need for human emotions. Since this is a program, it does not get scared of the high volatility of the market and makes false judgments leading to loss. It always analyzes the market data, identifies opportunities, and executes trades that would lead to profit most of the time.

Disadvantages of Using Crypto Trading Bots

- Need a Running PC: Crypto trading bots need to run constantly so they need your computer to also be running in order to keep their programs operational.

- Need Coding Knowledge: Setting up can become a hassle as you would need to have a basic understanding of coding as well as trading strategies that may work in the market.

- High Probability of Scam: If you’ve downloaded a free bot, there is a high probability that it is a scam and the bot may effectively not only lose most of your trades but since it has access to your whole portfolio, it may transfer most of your digital assets to the programmer/scammer who developed it.

Examples of Popular Crypto Trading Bots

There are many kinds of automated crypto trading bots out there. Let’s have a look at a few of the most popular crypto trading bots available on the internet today.

Bitcoin Bot

It is one of the few trustworthy free online Bitcoin trading bots. It allows you to set up your trading strategies and use external signals to execute your trades. It can be integrated into many major exchanges like Coinbase and Robinhood etc.

You can access Bitcoin Bot directly from their website. While it is still a new bot, we still need more information to verify its trust and effectiveness.

Coinrule

Coinrule is an automated trading bot provider with over 200 trading strategies. It has a risk-free demo feature that allows you to test your strategies before applying the bot to your trade accounts.

Coinrule has both a free and paid subscription plan with varying strategies available to you. It also has a price tracking feature that can track more than 200+ Cryptocurrencies simultaneously.

Unibot

Unibot is a Telegram bot that allows you to buy and sell cryptos directly from the Telegram messaging app. It is a decentralized finance (DeFi) bot that allows fast trading on Uniswap.

The platform has a token known as UNIBOT that offers many benefits like governing rights, reduced gas fees, etc. It also allows you to copy trades from other wallets and access new tokens as soon as they are launched.

Conclusion

Cryptocurrency trading bots can become an excellent tool for professional and experienced traders who are looking for automated trading strategies. Besides, we need to know that these bots are not plug-and-play money-making machines.

To make a successful trade using a bot you need to consider many factors including a sound strategy that you have thoroughly tested and have made successful trades on. Even then there are always other ways to make trades safely.